Aging Schedule Table For Outstanding Receivable Management Presentation Graphics Presentation PowerPoint Example

Content

AR dashboards are a useful tool for monitoring whether customers are paying on time and getting cash in-house quickly. Key dashboard features, such as customization by role and integration with accounting systems, let AR teams display real-time data and drill down into KPIs to increase a dashboard’s usefulness and benefits. As a management tool, accounts receivable aging may indicate that certain patients are not good credit risks. It can therefore help you make prudent decisions about whether or not to keep doing business with patients that are chronically late payers. A periodic report that categorizes your accounts receivable according to the length of time the patient’s balance has been outstanding.

What is a good AR aging percentage?

All A/R aged over 90 days falls in the inclusive A/R >90 day bucket. I'm often asked, what is a reasonable benchmark for receivables over 90 days old. Answer – 18-22% of total accounts receivable. A/R >90 days is a clear indicator of how effective your practice is at securing reimbursements in a timely manner.

You get access to our consistent team of experts — priced by the hour, so you only pay for what you need. We’re collaborative, explaining what the numbers mean, rather than just emailing reports. With Atradius Credit Insurance you can trade with confidence and explore new markets or products, knowing that your business is protected against credit risk such as the insolvency of your customers. You can use this exercise to note how evenly your customer base is spread. If a high concentration of your turnover is limited to a small number of customers, you may be at a higher risk of insolvency if that key source of income is lost. Conversely, customers that represent just a small part of your overall receivables should not make a great impact if they fail to pay you.

Aging data

Net receivables are the money owed to a company by its customers minus the money owed that will likely never be paid, often expressed as a percentage. This information is used to adjust the company’s financial statements to avoid overstating its income. Aging Categories The horizontal axis of the graph displays the aging categories . Each bar represents the outstanding billed amount for that aging category, as of today. Refresh the report and see the balance after paying the bills to get an up-to-date status. The IF statement considers all records in the view and filters out those that do not meet the specified condition.

Accounts receivable aging is a periodic report that categorizes a company’s accounts receivable according to the length of time an invoice has been outstanding. It is used as a gauge to determine the financial health and reliability of a company’s customers. The risk of losses can be reduced by skilled credit managers and related staff. Teams can get deeper insights with a trend analysis, which allows you to plot your receivables on a graph and use a trend line to predict how many receivables will be outstanding in a given future period. This method can also provide insight into issues such as bad debt ratios and other metrics used for long-term forecasting.

Aging schedule table for outstanding receivable management

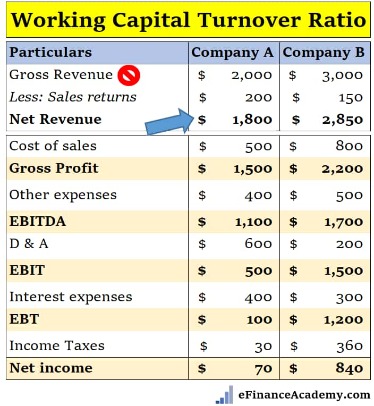

Most AR key performance indicators relate to the time to get cash into the company. Typical KPIs are days sales outstanding , accounts receivable turnover and collection effectiveness index . Accounts receivable success results in healthy cash flow — one of the biggest concerns for most businesses.

Continuous visibility at a glance using select KPIs, trends and customer information to monitor progress toward goals. Dashboards dedicated to AR metrics provide transparency and insight across AR processes. This can help a company shorten the order-to-cash cycle and maximize its working capital success. Brainyard delivers data-driven insights and expert advice to help businesses discover, interpret and act on emerging opportunities and trends. Square and Diagonal Graph Paper TemplateDownload this free graph paper template – Square and Diagonal Graph Paper. Octagonal and Square Graph Paper TemplateWe have a large number of graph paper templates available – check them…

What are the different views and how are they calculated?

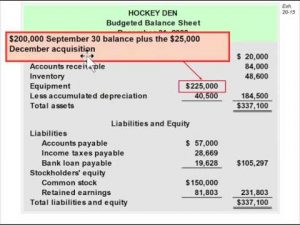

Preparation of an aging schedule may also help identify certain accounts that should be written off as uncollectible. We’ve got the sales by item, we’ve got the accounts receivable, we got the accounts payable, aging, then we have a graph, then we have the vendor balance. Again, we could probably format these graphs a little bit nicer.

And then and then you can actually print this report without, you know showing the data but just showing the graph if you would choose if you so choose to. And then I’m going to put the graph from Excel right underneath it or the graph that we’re going to copy from QuickBooks, let’s go back to QuickBooks. Here’s our graph there, we’re going to go back to excel, just insert that by going to the Insert tab, we’re going to go to the illustration, we’re going to go to the screenshot, and then I’ll take a clipping of it. Bad debt is an expense that a business incurs once the repayment of credit previously extended to a customer is estimated to be uncollectible. Bad debt expense is an expense that a business incurs once the repayment of credit previously extended to a customer is estimated to be uncollectible. The current period that I have the chart running for is from January 2016 until March 2017.

Accounts Receivable Aging Analysis

The secret to prompt payment lays in a systematic and consistent approach to credit management. Option to yield meaningful results, the character field must be sorted prior to aging. If the output table contains a large number of records, it is faster and more useful to save the results to a file than to display the results on the screen. Table, the column selection and order must be identical to the column selection and order in the existing table. For example, if an insurance company consistently pays claims late, it could indicate other underlying issues, like payment policy changes. If they have new processes for documenting and paying claims, your practice’s claims to them might continually be late until they iron out the kinks.

- These may be sold to collections, pursued in court, or simply written off.

- For example, if you don’t have any contra revenue, the monthly summary doesn’t include it.

- And then we go to go, we want a pie chart, we’ve been making these 3d pie charts.

- Access to real-time, summarized AR data can improve working capital management and cash flow forecasting, increase overall profitability, reduce customer credit risk and enhance employee management.

Entering a new geographical market can be fraught with risk including unfamiliar trade laws or practices, varying rules on imports and customs duties and potential political instability. A thorough risk assessment for each market you trade in will help you identify and take steps to minimise risk. Use this data to follow up with providers who have outstanding balances with your practice. This dashboard will provide an overview of your aging, indicating the breakdown between Responsible Party Aging and Insurance Aging to help give you a better view of which aging categories need more attention. Select this option and enter a number in the text box to start processing at the first record in the view and include only the specified number of records. Leave it selected to specify that all records in the view are processed.

Current accounts receivable is invoices that are outstanding but not due to be paid yet given the agreed-to billing terms. AR dashboards also highlight trends and provide transparency into the AR process, which can help companies avoid the accounts receivable aging graph costly effects of a substandard AR workflow. These include unbilled, misbilled or uncollected sales, unauthorized credits and deductions, misapplied payments, strained customer relationships, an underproductive staff and even fraud.

- It can include information such as charges, refunds, and dispute IDs.Line itemThis report provides a detailed view of revenue recognition on your account over the selected period, organized by line item.

- In midsize businesses, AR clerks might require AR-specific dashboards with more tactical information than their AR manager, who needs to monitor department operational performance.

- Other times, AR refers to the function within an accounting department that handles invoicing and processing payments from customers.

- In small companies, the bookkeeper might have an AR dashboard, or a more general dashboard customized with a section of AR-specific KPIs.

What is the aging schedule for accounts receivable?

What Is an Aging Schedule? An aging schedule is an accounting table that shows a company's accounts receivables, ordered by their due dates. Often created by accounting software, an aging schedule can help a company see if its customers are paying on time.